President Trump called ‘Liberation Day’ on April 2, 2025 due to the announcement of ‘mutual’ taxes against other countries. Since then, there is a lot of uncertainty and behind what is being paid and how much it is.

It has already had a failure on the PC gaming hardware industry, which relies heavily on the global supply chain, from manufacturing and supply chain to prices and shifting to the shipment. I am working through all the recent tariff news so that we have made some of the effects on the industry to make heads and tails, all that you can get down.

Effects on PC gaming gear so far

It is clear that prices can have a knock on consumer prices. As Best Best CEO explained back in March: “We expect our shopkeepers to reach some extent in this ranking to retailers, which will increase prices for US consumers.”

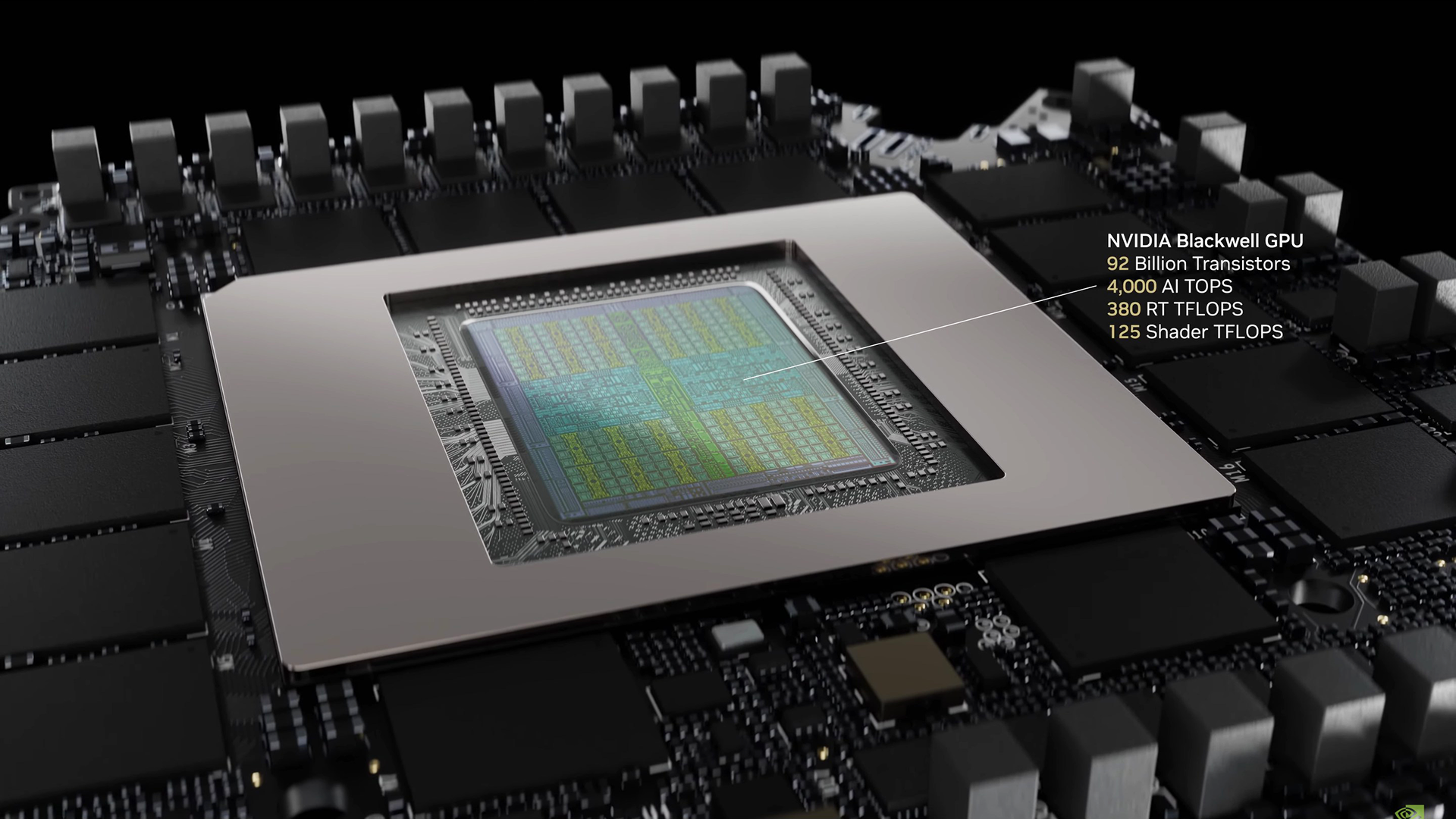

We have already seen reports that NVIDIA GPU prices have been raised for the same reason, as well as the book AIBs and retailers who have been forced to raise prices as a result.

But none of these have solid effects that we can identify, so let’s take a look at some of them.

Keep in mind that the following short -term effects are, and during the long -term, there may be professions that enable these short -term adverse effects or that these short -term positive effects are not worth it. I will leave it to find out about political and economic pundits.

Negative effects

The following revenues have some real -world impact that we have seen on the PC gaming hardware industry so far:

February 2025

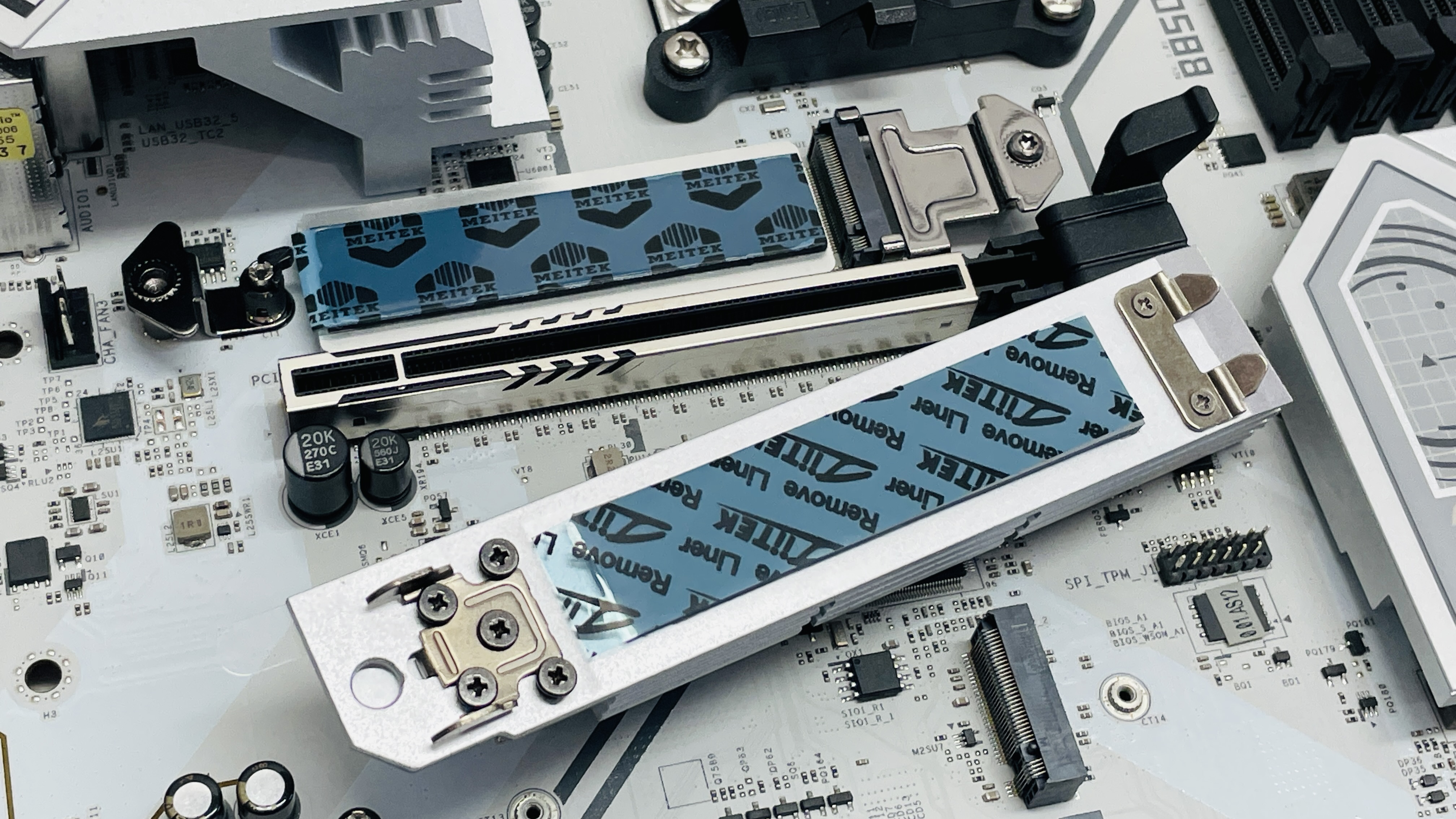

- Mother Board -making company Asrok says it will at least remove its manufacturing from China: “10 % tariff applied to other products like GPU cards, we need some time to move manufacturing to other countries.”

- In response to revenue, it will have to adjust the product’s price “,” said Eser said: “We think the import tax will probably increase the pre -default price due to import tax. It is very straightforward.”

- Hp Says By October, “less than 10 percent of the products coming from North America will come from China” will come from China due to its changes in its supply chain network.

April 2025

- The modular laptop and PC maker framework have temporarily paid some framework on US sales of some framework 13 laptops due to new prices imposed on April 5. “This Resumed later.Although the framework says it will “update pricing to add tariff effect.” Now that the revenue has been reduced once again, the framework will “adjust the prices on the parts and modules that are manufactured in China to reflect less revenue.”

- Heritage Saying in a Reddate question and answer That it has to stop a lot of orders because of the revenue: “We are still taking all the products that we have pre -order from users. Everything else is stopped or diverted to other regions.”

- 8 Batdo sends shipping from its warehouses in China, but it resumed later.

- Razer stopped purchase of a direct laptop in the United States, but This resume In the later month

Positive effects

There have also been some positive effects that can be at least partially due to taxes – positive, that is, if you live in the United States. Although we must keep in mind that it is difficult to say how much of the revenue has an impact on these investment decisions compared to other factors such as previous investment.

March 2025

And have been (alsoSoftbank, apples, and so on), But these are both important that the PC gaming hardware industry is relevant. It is important to note that any potential positive effects will take a long time to come under full force.

Its important benefits can be more manufacturing in the United States and usually takes a long time to set up supply chains from China, but manufacturing, and it may take a long time to adjust the supply chain.

Basically, what are US taxes?

Tariff is a levy that is imposed on importing some products from another country. If imported from a country, people of the country will have to pay additional taxes for these products. It is believed that people in the house should be encouraged to buy these products from their home instead of importing from anywhere, as tariff imports become very expensive.

US prices had an impact before the second Trump administration, but since the beginning of April 2025, US President Donald Trump introduced widespread ‘mutual’ taxes against various countries and industries. A few days later, Trump returned to prices against most countries, but jack them against China. China is partly the main target of US prices due to the ongoing trade war and technical ‘arms race’.

Although semiconductors and computer parts were initially exempt from major mutual rates (but not from base tariffs, such as 20 % ‘fentine’ taxes), before the United States began investigating the impact of the impact on the national security of the semiconductor and computing imports. Whether it, in fact, will see big taxes in the coming weeks and months, this is an open question.

After that, the United States and China put a 90 -day break at large mutual rates, which fell from 145 % and 125 % to 30 % and 10 %, respectively. In addition to these, there were already some duties, though, this may mean that the revenue is actually a bit higher than those numbers.

Financial Times explains: “Consultancy Capital Economics calculated that due to the duties of Trump’s return to power this year, US revenue on China will now reach about 40 percent, while Chinese revenue on the United States will be about 25 percent.”

In addition, these rates are left only against some goods, and what will happen to the semi -conductors is not yet known. The pause does not apply to semiconductor, and the United States is still deciding what to do about chips and computers.

Why do taxes affect PC gaming gear?

Despite reducing mutual rates, there are still widespread revenue, and there is a lot of uncertainty around the destiny of the semiconductor and derivative imports as well as the relevant computing products. It seems that the United States is still finding out what to do with them.

This kind of uncertainty can be part of the project: the United States can initially keep prices lower than the risk, but if this risk still decreases, companies can still transmit manufacturing from China and to the United States, regardless of.

Many PC hardware companies have the least part of the manufacturing in China. Even for many companies this is true that we cannot expect in the beginning. For example, the American company is made from the courser some PSUS as weather, and there are seasonal factories Is located in china.

If companies continue to manufacture in China and other highly tariffs, American consumers will have to pay a big tax on these products, and they may stop buying them. America has been given The world’s largest consumer marketMany companies would like to keep the country’s companies and people as their customers.

So we can expect that at least some companies can try to do the work they can move somewhere else, possibly to the United States. But such changes may take time, and in the meantime, we can expect some PC gaming tech to remove prices, until manufacturing companies have reduced prices to calculate new prices. However, in the thin margin industries, companies will not be able to do so often or too long.