On Friday, the Trump administration exempted the hardware burden of smartphones and other computing hardware from China’s 145 % of the monster of goods. But until Sunday, the president already seemed to be retreating, and on the society of truth, explaining that there is no exemption here, it is just the product classes. Went into a new tariff “bucket”. Sorry, what?

In short, it is very impossible to maintain late tariff chaos. But here is how these words are being written at that moment, and how these words are being written and how it all applies to the PC, at least as much as anyone can say.

On Friday, the Trump administration announced a 145 % tariff exemption on goods imported from China to the United States. In other device and product types, these little ones include smartphones, laptop computers, hard drives, CPUs, memory chips as well as flat screen display.

20 entries are listed in the US Customs and Border Protection website, and it seems that the PC and all the components that go into it are widely and perhaps fully covered.

The catch is that by Sunday, it was revealed that the Trump administration did not see this set of clear waivers, well, exempt. Instead, US Commerce Secretary Howard Lotnik told TV Network ABC That these devices and products will rather be subject to separate taxes, including large -scale computer chips and will be implemented “in a month or more.”

Then President Trump told reporters while traveling in Air Force One that he would be To announce new revenue on semiconductor in the coming week. When asked if some products such as smartphones and computing hardware could be exempt, Trump said he could be. “You have to show a special flexibility. No one should be so hard,” he said.

After that, he said on the truth, saying, “There was no tariff ‘on Friday.”

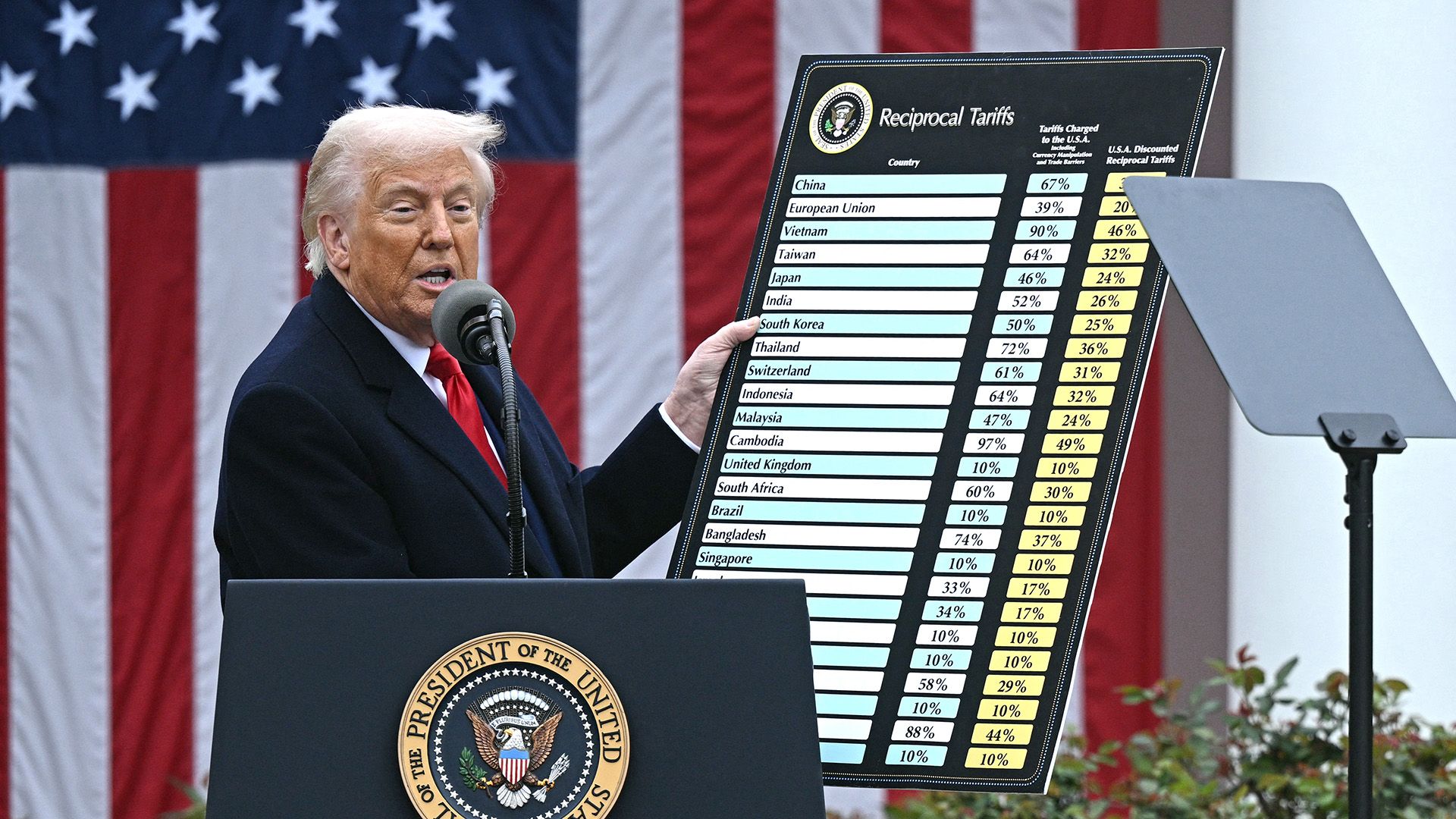

Then, to retrieve, the Trump administration reached a total of 145 % to make the rates at least 20 % tariffs on most goods from China, which issued a rate of 125 % for computing and electronics products, announcing a plans for announcing a plan to use some similar plans.

Recently. At present, it is impossible to say what taxes will apply to computing goods and how long they will last. However, because of the administration’s seemingly unwantedness to remain with the truly convicted taxes on the goods to consumers, it is unlikely that too much tariff rates will apply to PC hardware.

Therefore, something seems to be in the 10 % -20 % range. Not complete destruction, but still far from welcome, especially, for the choice of graphics cards, which are already extremely expensive. If we are guessing, we also expect that consumers eliminate prices can be pushed more than the heading tariff rate.

Given the quantity of chaos around the prices, the costs that go beyond the simple tariff rate that will potentially be delivered to consumers, eventually. All of this means that even if the most destructive scenario contained in hardware counting prices or is no longer more likely, we should all probably make more prices in the short to medium.